Book Appointment Now

South America Medical Tourism: Costs, Best Countries & 2025 Trends

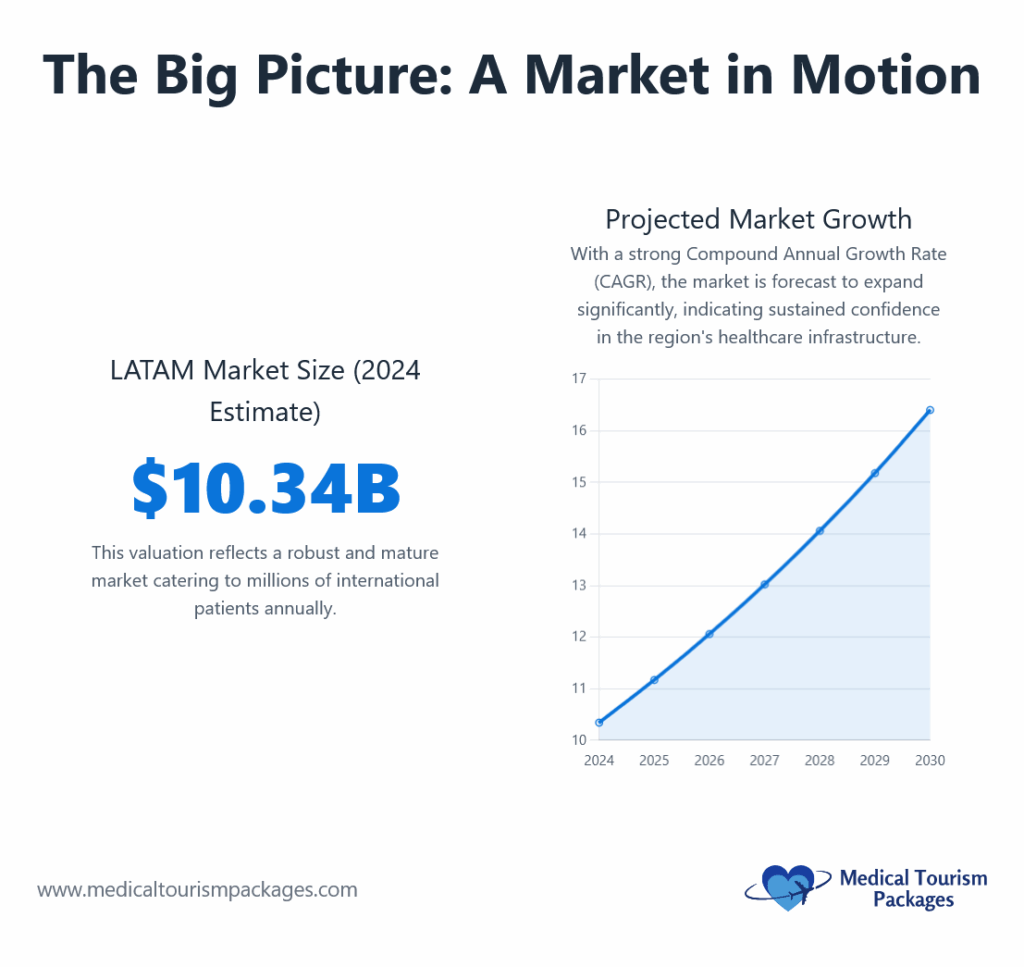

South America’s medical tourism market is experiencing unprecedented growth. The regional market reached US$545M in 2024 and is projected to US$1.407B by 2035 (~9% CAGR).

Globally, medical tourism is projected to grow at ~18.47% CAGR (2025–2030), from $31.09B (2024) to $87.33B (2030), with Latin America capturing an increasing share of international patients seeking high-quality, affordable care.

Why Patients Choose Latin America for Medical Tourism

Patients typically save 40-80% compared to U.S. prices without compromising quality. These savings stem from lower operational costs, favorable exchange rates, and competitive healthcare markets—not reduced standards of care.

The region has invested heavily in modern facilities and JCI-accredited centers. Examples include Hospital Israelita Albert Einstein (São Paulo) and Hospital Moinhos de Vento (Porto Alegre). Always verify a facility’s current status in JCI’s directory before booking.

Leading hospitals now offer cutting-edge treatments using robotic surgery systems, AI-powered diagnostics, and 3D medical printing. Wait times are minimal compared to developed countries, with many procedures scheduled within weeks rather than months.

Country Deep-Dives: Decision Framework

Colombia: Cosmetic and Dental Value Leader

Specialties: Cosmetic surgery, dental veneers, implants, body contouring Savings: 60-80% below U.S. costs Timeline: Single-visit dentistry often completed in 3-7 days

Colombia delivers exceptional patient satisfaction with dramatic cost savings. A clinic-level study in Cartagena (2016–2018) reported that 98.2% of 460 international plastic-surgery patients would refer that clinic; this reflects one practice, not a national rate. The country excels in smile makeovers and complex dental reconstructions using premium materials.

Quality signals: JCI-accredited options (e.g., Fundación Cardioinfantil, Bogotá); verify current status in the JCI directory.

Panama: USD Currency and Johns Hopkins Standards

Specialties: Orthopedics, cardiology, stem cell therapy Unique advantages: USD economy, 180-day visa-free entry for Americans Quality anchor: Pacífica Salud – Hospital Punta Pacífica is affiliated with Johns Hopkins Medicine International (verify current JCI status in the directory).

Panama caters to patients prioritizing U.S.-comparable standards for complex procedures. The dollarized economy eliminates currency risk, while direct flights from major U.S. cities reduce travel stress. Note that some advanced therapies (e.g., stem-cell) are regulated—patients should verify indication and protocol with the provider.

Costa Rica: Dental Excellence and Eco-Recovery

Specialties: Dental implants, All-on-4 systems, full mouth restorations Savings: 40-70% with premium materials Experience: Seamless integration of treatment with wellness tourism

Costa Rica’s dentists often train in the U.S. or Europe, using high-grade American and German materials. The “Pura Vida” recovery environment combines world-class care with restorative natural settings.

Mexico: Scale, Proximity, and Border Convenience

Market size: Analyst estimates for Mexico’s market vary; traveler volumes and spend are dispersed across border and interior hubs Specialties: Bariatric surgery, dentistry, cosmetic procedures

Mexico’s strategic proximity to the U.S. has created sophisticated cross-border healthcare infrastructure. Cities like Tijuana feature purpose-built clinics with English-speaking staff and streamlined logistics for American patients.

Notable: Médica Sur (Mexico) and, since June 30, 2025, Hospital Internacional de Colombia (HIC) are members of the Mayo Clinic Care Network.

Brazil: Global Aesthetic Surgery Capital

Market leadership: Brazil ranks #1 globally for surgical aesthetic procedures (ISAPS 2023). Market size: $3.10 billion in 2024, projected $14.84 billion by 2033 Specialties: Cosmetic surgery, advanced cardiology, complex dental work

Brazil’s surgeons are globally renowned for innovation in liposuction, breast augmentation, and facial procedures. Examples of JCI-accredited facilities include Hospital Israelita Albert Einstein (São Paulo) and Hospital Moinhos de Vento (Porto Alegre) – verify current status in the JCI directory.

Argentina: High-Potential Currency Play

Specialties: Cosmetic surgery, fertility (IVF), dentistry, orthopedics Unique advantage: “Blue dollar” exchange rates create exceptional value Considerations: Economic volatility affects predictability

For cash-paying patients, Argentina’s unofficial exchange rates can provide savings exceeding the already low list prices, making procedures exceptionally affordable.

Chile: Stable, Advanced Care

Specialties: Oncology, cardiovascular care, orthopedics Strengths: Political stability, advanced private healthcare sector Target patients: Risk-averse patients seeking complex care

Chile offers a modern, regulated environment with European-standard facilities. Leading hospitals like Clínica Alemana operate at international benchmarks.

Peru: Emerging Market with Verified Quality

Differentiator: JCI-accredited options exist (e.g., Clínica Anglo Americana, Lima); verify current status in the JCI directory. Specialties: Cardiac surgery, neurosurgery, dental care Strategy: Focus exclusively on JCI-accredited private facilities

Peru’s concentration of internationally accredited facilities provides clear quality benchmarks for discerning patients willing to explore a well-credentialed emerging market.

Cost Comparison: 2025 Indicative Prices

As of September 2025. Prices represent typical ranges and vary by case, materials, and add-ons. Always request detailed quotes.

| Procedure | U.S. Typical | Colombia | Costa Rica | Mexico | Brazil |

|---|---|---|---|---|---|

| Veneers (per tooth) | $1,200–$2,500 | $300–$650 | $550–$600 | $500–$800 | $500–$900 |

| All-on-4 (per arch) | $24,000–$30,000 | $4,500–$6,000 | $8,500–$13,000 | $8,000–$11,000 | $10,000–$14,000 |

| Rhinoplasty | $7,000–$15,000 | $2,500–$4,500 | $3,500–$5,500 | $3,000–$6,000 | $3,500–$6,500 |

| Hip Replacement | $39,000–$50,000 | $8,400–$15,000 | N/A | $12,000–$18,000 | $12,000–$20,000 |

Quality and Safety Signals: Your Verification Checklist

JCI Accreditation Verification

Always verify claims using the official Joint Commission International directory. Navigate to their “Find Accredited International Organizations” portal and search by country and hospital name. Confirm:

- Current accreditation status

- Specific accredited programs

- Effective dates

Additional Quality Indicators

- Physician credentials: U.S./European training and board certifications

- Institutional affiliations: Johns Hopkins (Panama), Mayo Clinic Network (Mexico)

- Technology capabilities: Robotic surgery systems, 3D imaging, CAD/CAM dental labs

- Patient outcomes: Published success rates and satisfaction scores

Red Flags to Avoid

- Unverified accreditation claims

- Lack of English-speaking medical staff

- No clear post-operative follow-up protocol

- Pressure for immediate decisions without consultation

Travel and Recovery Practicalities

Always confirm entry rules with the destination’s official sources; durations are maximums and can be shorter at officer discretion.

- Panama: Visa-free up to 180 days for U.S. tourists.

- Colombia: Visa-free 90 days per entry; up to 180 days/year in total.

- Costa Rica: Visa-free up to 180 days for U.S. travelers; immigration sets the permitted stay on arrival (check your stamp).

- Mexico: FMM allows up to 180 days, but officers may grant fewer based on your purpose/docs.

Language Support

Top medical tourism providers offer dedicated international patient coordinators and multilingual staff. English fluency is standard in accredited facilities.

Recovery Timelines

- Dental procedures: 3-7 days for routine work, 7-14 days for complex cases

- Cosmetic surgery: 10-21 days initial recovery

- Orthopedic surgery: 2-4 weeks depending on procedure complexity

Specialized recovery houses in cities like Medellín, Tijuana, and San José provide 24/7 nursing care, medical transportation, and post-operative support.

How to Choose Your Destination

7-Point Decision Framework

- Match procedure to specialty hubs (Colombia for veneers, Mexico for bariatrics)

- Verify provider credentials through official directories

- Calculate total trip costs including travel and accommodation

- Assess quality signals beyond just price

- Confirm post-operative support protocols

- Review patient testimonials and outcome data

- Plan for follow-up care both abroad and at home

Quick Destination Selector

Prioritizing maximum savings: Colombia, Mexico

Seeking premium quality assurance: Panama, Costa Rica

Want integrated wellness experience: Costa Rica, Brazil

Need complex surgery with U.S. standards: Panama, Chile

Exploring emerging value: Peru, Argentina

Frequently Asked Questions

How much can I save in 2025?

In 2025, typical savings through medical travel range from 40% to 70%, depending on the procedure and destination. For instance, dental veneers in Colombia cost $300–$650 per tooth versus $1,200–$2,500 in the U.S., and All-on-4 dental implants cost $4,500–$6,000 abroad compared to $24,000–$30,000 domestically.

Are hospitals properly accredited?

Yes, many hospitals in countries like Brazil, Colombia, Mexico, Panama, and Peru are accredited by the Joint Commission International (JCI). Always verify a provider’s current accreditation status via the official JCI international directory before booking.

Is medical travel to these countries safe?

Medical tourism is generally safe in countries like Colombia, Costa Rica, Mexico, and Panama when you choose accredited facilities and qualified providers. Ensure that the hospital or clinic is JCI-accredited and that surgeons are properly certified.

How long do I need to stay?

Length of stay depends on the procedure. Dental work typically requires 3–7 days, while complex treatments like All-on-4 implants may take 7–14 days. Cosmetic surgeries usually need 10–21 days for initial recovery and clearance to fly home.

Will my FMM be 180 days in Mexico?

Mexico’s FMM tourist permit can allow up to 180 days, but immigration officers decide the duration based on your travel purpose and plans. If you’re visiting for medical treatment, request the appropriate duration and state your reason clearly.

What about post-operative care?

Many top providers offer telemedicine follow-ups directly with your surgeon. Additionally, recovery houses in major destinations provide 24/7 nursing care, medication support, and transport to follow-up visits, enhancing safety and comfort during your stay.

Ready to explore your options? Get a free consultation to compare costs and providers, or request custom quotes for your specific procedure and destination preferences.