Book Appointment Now

Hair Implant Industry in Latin America: Market Analysis, Top Destinations, and Cost Guide

Hair loss affects millions of people worldwide, driving demand for permanent solutions beyond topical treatments and medications. Hair transplant surgery has emerged as the gold standard for restoring natural-looking hair, and Latin America has positioned itself as a competitive alternative to procedures in North America and Europe.

The region offers FDA-approved techniques at prices often 50-70% lower than US costs. This cost advantage, combined with experienced surgeons and modern facilities, has made Latin American countries increasingly attractive to international patients. Medical tourism for hair restoration has grown significantly across the region, with several countries developing specialized expertise in follicular unit extraction (FUE) and follicular unit transplantation (FUT).

This analysis examines the hair implant market across Latin America. We identify leading destinations, compare pricing structures, and evaluate factors that influence both cost and quality. For patients considering treatment abroad, understanding regional differences in technique, regulation, and outcomes is essential to making an informed decision.

What is the Hair Implant Industry in Latin America?

The hair implant industry in Latin America encompasses surgical hair restoration services offered across multiple countries in the region. These procedures primarily use two techniques: follicular unit extraction (FUE) and follicular unit transplantation (FUT). Both methods involve harvesting hair follicles from donor areas and transplanting them to balding or thinning areas.

Key Market Statistics:

- Hair transplant procedures cost up to 80% lower than USA or Europe

- Procedural volume CAGR of 15.58% annually (2020-2025)

- Annual procedures estimated to increase from 134,000 to 179,000

- Medical tourism sector forecast to grow from $7.36 billion (2022) to $12.21 billion (2025)

Latin America has become a major player in global medical tourism for hair restoration. The price difference stems from lower operational costs, favorable exchange rates, and competitive labor markets, while many clinics maintain international accreditation standards.

Several factors support the industry’s expansion. Improved clinic infrastructure, surgeon training at international institutions, and digital marketing to foreign patients have all contributed to increased visibility. Many leading clinics now offer multilingual staff, patient coordinators, and partnerships with local hotels to streamline the medical tourism experience.

Why is Latin America Becoming a Leading Destination for Hair Transplants?

Latin America has emerged as a preferred destination for hair transplants due to a combination of cost advantages, quality standards, and growing patient acceptance of international medical travel.

Key Growth Drivers:

- 45.81% of patients globally express willingness to travel for hair procedures

- 63.7% of medical tourists consider accreditation a significant factor when selecting providers abroad

- The region’s growth rate (15.58% CAGR) significantly outpaces Europe (8.34% CAGR)

- Cost savings of up to $25,000 compared to US prices

Many Latin American hair transplant clinics have responded by obtaining certifications from organizations like Joint Commission International (JCI) or the International Society of Hair Restoration Surgery (ISHRS). These credentials help establish trust with international patients who might otherwise hesitate to travel for medical procedures.

Geographic proximity to North America reduces travel time and jet lag. Many countries require no visa for US and Canadian citizens. Spanish and Portuguese language barriers are mitigated by bilingual medical staff at international-focused clinics. Finally, patients can combine medical treatment with tourism in destinations known for culture, beaches, and affordability.

What are the Major Hair Implant Markets in Latin America?

Three countries dominate the Latin American hair transplant market: Mexico, Brazil, and Colombia. Each offers distinct advantages based on geography, regulation, and market positioning.

Market Comparison by Country

| Country | Market Share | Key Advantages | Regulatory Body | Price Range | Primary Patient Source |

| Mexico | 39.75% | US border proximity, established infrastructure | COFEPRIS | $2,000-$5,500 | USA/Canada |

| Brazil | 35.71% | Large domestic market, ANVISA standards | ANVISA | $3,500-$6,000 | Domestic |

| Colombia | 12-15% (est.) | Cosmetic surgery reputation, comprehensive packages | Ministry of Health | $2,000-$5,000 | International mix |

Mexico’s Advantages:

- Strategic position adjacent to high-cost US market

- Cities like Tijuana, Mexicali, and Monterrey developed as medical tourism hubs

- Flight times from major US cities rarely exceed four hours

- Many border cities accessible by car

- Bilingual staff and US-based patient coordinators

Brazil’s Strengths:

- Strong domestic consumer base despite geographical isolation from North American tourism

- Higher clinical standards through ANVISA regulation

- Major cities like São Paulo and Rio de Janeiro host numerous specialized clinics

- Cultural emphasis on appearance sustains substantial procedure volumes

Colombia’s Position:

- Already renowned as a hub for cosmetic surgery

- Comprehensive packages typically include the transplant procedure, consultations, medications, and follow-up

- Clinics often market combination procedures for patients seeking multiple treatments

- Established cosmetic surgery infrastructure with readily available support services

How Much Do Hair Implants Cost in Latin America?

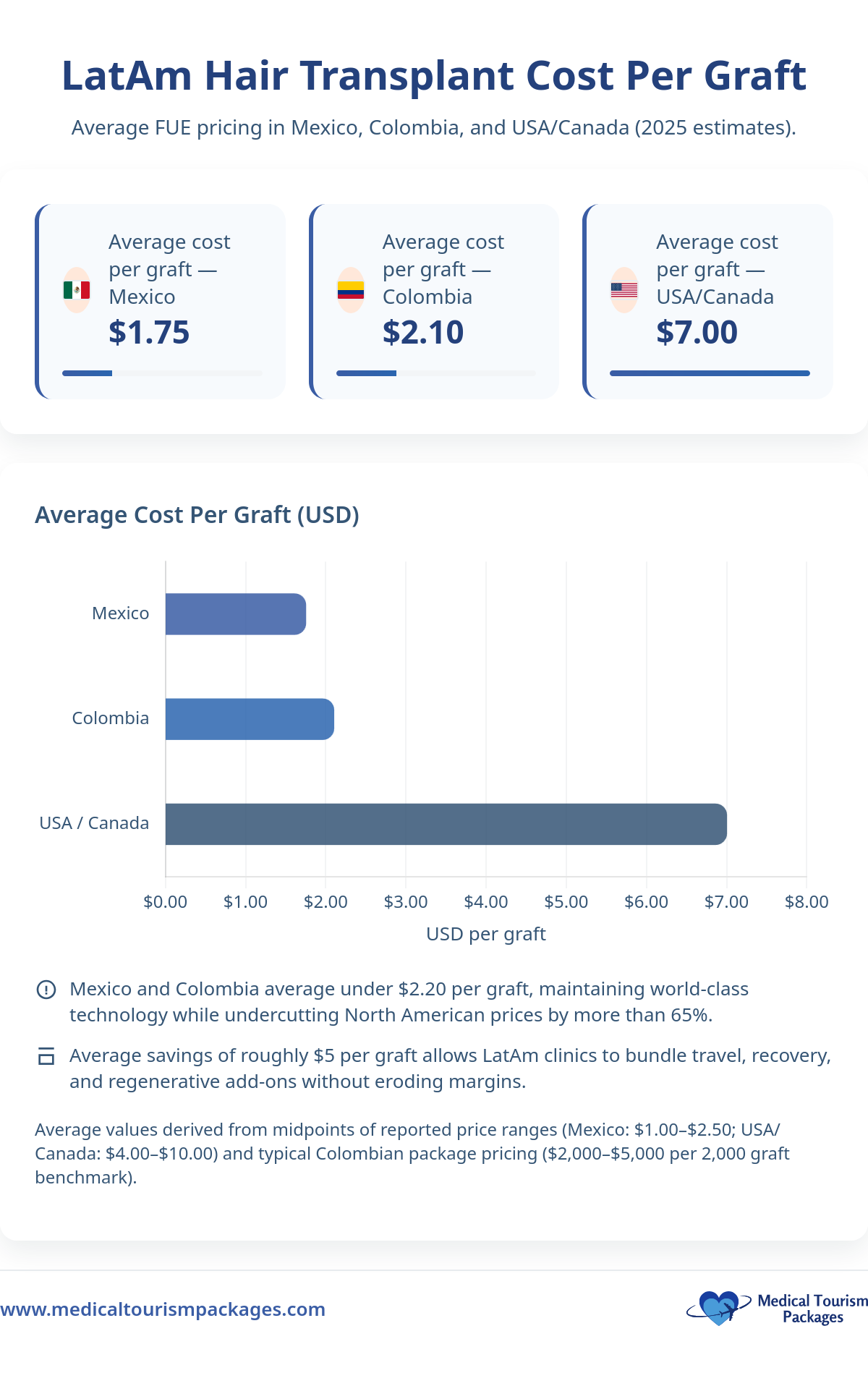

Hair transplant costs in Latin America vary by country, technique, and clinic reputation. The region offers significant savings compared to North American and European prices while providing multiple procedural options.

Cost Breakdown by Country and Technique

| Country | FUE Cost | FUT Cost | DHI Cost | Robotic (ARTAS) | Cost Per Graft | Financing Options |

| Mexico | $4,000-$4,500 | $3,250 | $2,000 | $5,500 | $1.00-$2.50 | Payment plans available |

| Colombia | $2,000-$5,000 | Included in packages | Included in packages | Limited | $1.50-$3.00 | Credit cards, payment plans |

| Brazil | $3,500-$6,000 | $3,000-$4,500 | $4,000-$6,500 | $6,000-$8,000 | $2.00-$3.50 | 0% financing available |

| Argentina | $2,500-$4,500 | $2,000-$3,500 | $3,500-$5,000 | Limited | $1.50-$2.75 | Payment plans |

| Costa Rica | $4,500-$7,000 | $3,500-$5,500 | $5,000-$7,500 | $7,000-$9,000 | $2.50-$4.00 | Medical tourism loans |

Understanding Technique Pricing:

- FUE: Most common technique, minimal scarring, $4,000-$4,500 in Mexico

- FUT: Strip harvesting method, lower cost at $3,250 in Mexico

- DHI: Specialized Choi pen implantation, $2,000 in Mexico (verify graft count)

- Robotic ARTAS: Precision extraction, $5,500 in Mexico vs. $15,000-$25,000 in US

Many clinics price procedures by graft count rather than flat rates. A procedure requiring 2,000 grafts would cost $2,000 to $5,000 at Mexico’s per-graft rates of $1.00-$2.50.

What Types of Hair Transplant Procedures are Available?

Latin American clinics offer four primary hair transplant techniques, each with distinct advantages, costs, and outcomes.

Procedure Comparison

| Procedure Type | Global Market Share | Graft Survival Rate | Price Range in LatAm | Key Features |

| FUE | 66% | 85-95% | $4,000-$6,000 | Individual extraction, minimal scarring, 6-8 hour procedure |

| FUT | 28% | 90-95% | $2,000-$4,500 | Strip harvesting, linear scar, faster extraction, higher graft yield |

| DHI | 5% | 90%+ | $2,000-$6,500 | Choi pen implantation, no channel creation, precise angle control |

| Robotic (ARTAS) | 1% | 85-90% | $5,500-$9,000 | Automated extraction, AI mapping, consistent harvesting depth |

Each technique serves different patient needs. FUE dominates due to minimal scarring, FUT offers economy and efficiency, DHI provides precision for hairline work, and robotic procedures ensure consistency across large graft counts.

Who Can Get Hair Implants in Latin America?

Hair transplants in Latin America serve a diverse patient population spanning age groups, genders, and motivations.

Patient Demographics and Motivations

Demographics:

- Average age: 37 years globally

- Gender split: 40% women patients

- Age brackets: 25-35 (preventive), 36-50 (largest segment), 50+ (extensive restoration)

Primary Motivations:

- 90% to feel more attractive

- 63% to appear younger for workplace

- Social confidence and relationship dynamics

- Life transitions (career changes, divorce, milestones)

Medical Candidacy Requirements:

- Sufficient donor hair density

- Stable hair loss pattern

- Good overall health

- Realistic expectations (12-18 month growth timeline)

- Age 25+ preferred for pattern stability

Correlation with Severity: Direct correlation exists between hair loss severity and willingness to pay. Patients with advanced Norwood Scale classifications (V-VII) show greater willingness to invest in comprehensive restoration.

When is the Best Time to Get Hair Implants in Latin America?

Timing a hair transplant involves medical, seasonal, and market considerations.

Optimal Timing Factors

Medical Timing:

- Under 25: Generally wait unless severe loss

- 25-30: Suitable if loss stable for 1-2 years

- 30+: Most show predictable patterns

Seasonal Considerations:

| Season | Advantages | Disadvantages |

| Fall/Winter (Oct-Mar) | Cooler temperatures, less sweating, lower tourism volumes | Holiday scheduling conflicts |

| Spring (Apr-May) | Moderate weather, good healing conditions | Higher tourism prices |

| Summer (Jun-Sep) | Work/school breaks available | High temperatures, sun exposure risks |

Market Factors:

- Global market saw 4% decrease in 2020, but LatAm showed strong rebound

- Leading clinics book 2-3 months in advance

- Exchange rate fluctuations can affect pricing by 5-15%

Planning Timeline:

- Book 2-3 months in advance for preferred surgeons

- Allow 7-10 days away from work

- Schedule at least 2 weeks before important events

- Consider year-end holidays for extended recovery time

What are the Main Steps to Getting Hair Implants in Latin America?

Getting a hair transplant in Latin America involves five key phases: clinic selection, consultation, the procedure itself, post-operative care, and monitoring results.

How Do You Choose the Right Clinic?

Key Questions to Ask:

- Years performing hair transplants

- Annual procedure volume

- Percentage of practice dedicated to hair restoration

- Complication rates and management protocols

- Specific experience with your hair type/pattern

| Credential | What It Means | How to Verify |

| ABHRS Certification | Specialized hair restoration training and examination | abhrs.org directory |

| FISHRS Fellowship | Elite peer-reviewed expertise (top 10% of surgeons) | ishrs.org member search |

| JCI Accreditation | International healthcare facility standards | jointcommissioninternational.org |

| ISO Standards | Quality management systems compliance | Request certificates, verify issuing body |

| COFEPRIS/ANVISA License | National regulatory compliance | Government websites |

What Happens During the Initial Consultation?

Consultation Components

Pre-Consultation Requirements:

- Frontal, profile, and crown photographs

- Medical history forms

- Current medications list

During Consultation:

- Hair loss pattern assessment (Norwood/Ludwig Scale)

- Donor area density evaluation

- Realistic outcome discussion based on available grafts

- Technique recommendation (FUE, FUT, DHI, robotic)

- Cost breakdown and what’s included

In Mexico, clinics must submit technical dossiers to COFEPRIS with proof of safety and efficacy. Patients can request evidence of this compliance.

How is the Hair Transplant Procedure Performed?

Procedure Timeline

| Phase | Duration | What Happens |

| Preparation | 1 hour | Local anesthesia, area marking, photographs |

| Extraction | 2-3 hours | FUE: Individual extraction; FUT: Strip removal |

| Graft Preparation | 1-2 hours | Sorting and storing in holding solution |

| Implantation | 2-3 hours | Creating sites and placing grafts |

| Final Review | 30 min | Instructions, medications, scheduling follow-up |

Advanced Technologies:

- ARTAS robotic system for consistent extraction

- TJ Hair System™ integrating FUE, DHI, and Sapphire technologies

- Sapphire blades for smaller, more precise channels

What Does Post-Operative Care Include?

Recovery Timeline

| Timeframe | Care Requirements | Restrictions |

| Days 1-3 | Elevated sleep, special shampoo, medications | No touching grafts, no exercise |

| Week 1 | Gentle washing begins day 3-5 | Avoid sun, strenuous activity |

| Weeks 2-4 | Scabs fall naturally, shock loss begins | No contact sports, swimming |

| Months 1-3 | Normal activities resume | Continue sun protection |

Advanced Treatments:

- Lab-grade stem cells or exosomes to promote healing

- PRP therapy to stimulate follicles

- All-inclusive packages with accommodation, transfers, and follow-up

When Do Final Results Appear?

Growth Timeline:

- Weeks 2-3: Transplanted hairs shed (normal)

- Months 3-4: New growth begins

- Months 6-8: 50-60% density visible

- Months 9-12: 80-90% growth complete

- Months 12-18: Final results with full maturation

Robotic precision methods ensure natural growth patterns, though individual healing varies. Transplanted hair is permanent but non-transplanted areas may require ongoing treatment.

How Do Latin American Hair Implant Standards Compare Internationally?

Latin American hair transplant standards vary significantly by country and clinic. While top facilities match or exceed international benchmarks, the region shows inconsistent enforcement of regulations.

What Certifications Should Clinics Have?

Key Certifications and Significance

Essential Certifications:

- JCI Accreditation: Gold standard for international healthcare facilities; requires rigorous on-site inspections every 3 years

- ISO 9001/13485: Quality management systems and medical device standards

- ABHRS Certification: Physician-only certification requiring specialized training and examinations

- FISHRS Fellowship: Highest ISHRS designation; extensive peer review of surgical outcomes

Additional Credentials:

- National board certifications in plastic surgery or dermatology

- ISHRS membership (basic membership vs. Fellowship)

- Device manufacturer training certificates (ARTAS, NeoGraft)

Example: Dr. Alba Reyes became the first ABHRS-certified surgeon in the Dominican Republic, illustrating how this certification distinguishes practitioners in regions where hair restoration training may be less standardized.

How are Surgeons Licensed and Trained?

Training Pathways:

- Medical school and national licensure (baseline requirement)

- Fellowships with established surgeons (3-12 months)

- Industry-sponsored training courses (2-5 days)

- Conference workshops and mentorship

- Self-directed learning and practice development

FISHRS Fellowship as Differentiator:

- Only ~10% of hair restoration surgeons achieve Fellowship

- Requires consistent surgical outcomes across diverse patients

- Must contribute through publications, lectures, or teaching

- Demonstrates 20+ years experience for regional pioneers

What Safety Protocols are Required?

Regulatory Requirements by Country

| Country | Regulatory Body | Key Requirements |

| Mexico | COFEPRIS | Scientific substantiation for claims, facility licensing, sanitary standards |

| Brazil | ANVISA | Product registration, facility inspection, advertising restrictions |

| Colombia | Ministry of Health | Medical director qualifications, infrastructure standards, emergency protocols |

| Other LatAm | Variable | Basic facility requirements, limited specific hair transplant standards |

Patient Verification Steps:

- Request facility licenses and accreditation certificates

- Ask about sterilization procedures

- Confirm emergency protocols and hospital transfer arrangements

- Review infection rates and complication management

Why Do International Patients Choose Latin America for Hair Implants?

International patients select Latin America for hair transplants based on cost savings, geographic accessibility, and increasingly sophisticated medical infrastructure.

What Percentage of Patients Come from Abroad?

Patient Origins:

- Primary source: USA and Canada

- Mexico border clinics: 60-80% international patients

- Colombia/Costa Rica: More diverse international mix

- Brazil: Predominantly domestic due to geographic distance

How Much Can Patients Save Compared to the US?

Regional Price Comparison

| Region | Cost Per Graft | Average Total Cost | Savings vs. US |

| USA/Canada | $4.00-$10.00+ | $12,000-$30,000 | Baseline |

| Mexico | $1.00-$2.50 | $2,500-$6,000 | 75-80% |

| Colombia | $1.50-$3.00 | $2,000-$5,000 | 78-83% |

| Brazil | $2.00-$3.50 | $3,500-$7,000 | 70-77% |

| Costa Rica | $2.50-$4.00 | $4,500-$8,000 | 60-73% |

Example Savings (2,500-graft FUE):

- US cost: $15,000

- Mexico cost + travel: $5,100

- Net savings: $9,900 (66%)

What Services Do Clinics Offer International Patients?

Comprehensive Service Offerings:

- Virtual consultations and assessment

- Bilingual staff and translators

- Airport transfers and accommodation

- Post-procedure support and medications

- Virtual follow-up at 3, 6, and 12 months

Specialized Services:

- Curly afro-hair transplantation (Colombia, Dominican Republic, Brazil)

- Combination procedures (beard, eyebrow transplants)

- Recovery hotels with medical staff

- US-based patient coordinators

What are the Success Rates of Hair Implants in Latin America?

Success rates for hair transplants in Latin America vary widely based on clinic quality, surgeon expertise, and technique employed.

Success Metrics

Measurement Factors:

- Graft survival rate: 85-95% at quality clinics

- Aesthetic naturalness

- Patient satisfaction alignment

- Complication avoidance

- Long-term retention

How Effective are Hair Transplants in Brazil?

Clinical Outcomes:

- FUE graft survival: 88-94%

- FUT graft survival: 90-95%

- Strong ANVISA regulatory oversight

- Comprehensive service models including:

- Micro Scalp Pigmentation for density illusion

- PRP therapy

- Medical management (finasteride, minoxidil)

What are Patient Satisfaction Rates in Mexico?

Key Findings:

- Quality and service cited as most important criteria (above price)

- Satisfaction rates exceed 85% at reputable clinics

- Border cities show widest quality variation

- Mexico City, Guadalajara, Monterrey have more consistent quality

How Common are Complications?

Complication Rates by Type

Minor Complications (5-15% at quality clinics):

- Temporary swelling

- Mild infection (oral antibiotics)

- Temporary numbness

- Ingrown hairs

- Excessive shock loss

Serious Complications (under 2% at accredited facilities):

- Severe infection requiring hospitalization

- Extensive scarring or keloids

- Permanent nerve damage

- Significant overharvesting

- Tissue necrosis

Black Market Problem:

- 51% of ISHRS members report black market operations in their cities

- Severe complications from non-sterile conditions

- Graft survival under 50%

- No recourse for problems

Which Technologies are Latin American Clinics Using?

Latin American hair transplant clinics have adopted technologies ranging from basic manual techniques to advanced robotic systems.

Is Robotic Hair Transplantation Available?

ARTAS System Features:

- AI mapping of donor area

- Consistent extraction depth and angle

- Real-time tracking and adjustment

- Transection rates under 5-8%

Availability:

- Mexico: Leading adoption (Capillus Robotics Center)

- Brazil: Limited to São Paulo, Rio de Janeiro

- Other countries: Minimal or no robotic infrastructure

- Cost: $5,500 in Mexico vs. $15,000-$25,000 in US

Limitations:

- Only performs extraction, not implantation

- Best for straight, dark hair

- High equipment costs limit availability

How is PRP Therapy Used with Hair Implants?

PRP Applications:

- Injected into recipient area post-placement

- Applied to donor area for healing

- Standalone treatments every 3-6 months

- Contains growth factors (PDGF, VEGF, TGF)

Advanced Regenerative Protocols:

- Exosome therapy from mesenchymal stem cells

- Adipose-derived stem cell applications

- Add $500-$2,000 to procedure costs

- Clinical evidence remains limited

What New Techniques are Being Adopted?

Emerging Techniques:

- FUE + DHI Combination: Speed of FUE with DHI precision

- Sapphire FUE: Crystal blades for smaller incisions

- Long Hair Transplantation: No shaving required

- Unshaven FUE: Discreet procedures

- Beard-to-Scalp: Alternative donor source

Market Context:

- Global market projected to reach $107.43 billion by 2032

- 26.5% CAGR from 2025

- Hybrid approaches becoming standard at leading facilities

What Challenges Does the Hair Implant Industry Face in Latin America?

The Latin American hair transplant industry confronts multiple challenges affecting quality consistency, market stability, and international reputation.

How Do Economic Factors Impact the Market?

Country-Specific Challenges:

Argentina:

- Hyperinflation exceeding 100% annually

- Multiple exchange rates (official vs. “blue dollar”)

- Equipment import costs spike with devaluation

- Brain drain of surgeons to stable countries

Brazil:

- Real fluctuation affects international pricing

- Domestic recessions reduce elective procedures

- Economic cycles impact demand

Regional Inequality:

- Per-capita income varies dramatically

- Smaller markets can’t support high-end facilities

- Bolivia, Paraguay, Ecuador have minimal infrastructure

What Infrastructure Limitations Exist?

Key Limitations:

- High incidence of unregulated procedures (51% of cities per ISHRS)

- Low barriers to entry in many jurisdictions

- Inconsistent enforcement even where regulations exist

- Social media enables fraudulent marketing

- Reputational contamination affects legitimate clinics

Physical Infrastructure Issues:

- Healthcare quality varies between metropolitan and rural areas

- Emergency access limitations in some locations

- Sterilization capability depends on reliable utilities

- Communication systems vary for telemedicine follow-ups

How Do Currency Fluctuations Affect Pricing?

Impact Examples:

- Mexican peso: 17-25 per USD (47% revenue variation)

- Colombian peso: 3,000-4,800 per USD (60% swing)

Clinic Strategies:

- USD-based pricing transfers risk to patients

- Dual pricing systems (domestic vs. international)

- Hedging arrangements for large clinics

- Buffer margins to absorb movements

- Quarterly rate adjustments

Regional Stability:

- More stable: Chile, Panama (USD), Costa Rica

- Moderate volatility: Mexico, Colombia, Brazil

- High volatility: Argentina, Venezuela

How Do You Verify a Hair Implant Clinic’s Credentials?

Credential verification represents the most critical step in selecting a hair transplant clinic in Latin America.

Verification Checklist

Red Flags to Avoid

Critical Warning Signs:

- Unverifiable credentials or vague claims

- Guarantees of specific outcomes

- Prices 50%+ below market rates

- High-pressure sales tactics

- Reluctance to show facility or provide references

- Stolen before-and-after photos

- No emergency protocols

Positive Experience Markers:

- FISHRS Fellowship (top 10% of surgeons)

- 20+ years focused practice

- 80%+ dedication to hair restoration

- Academic involvement (publications, teaching)

- 300+ procedures annually

- Systematic outcome tracking

- Transparent, realistic assessments

Verification Process Timeline

- Initial Research (1-2 weeks): Compile 5-10 clinics, verify credentials

- Initial Contact (1 week): Submit inquiries, evaluate responses

- Virtual Consultations (2-3 weeks): Interview top 3-4 candidates

- Reference Checks (1-2 weeks): Contact previous patients

- Final Verification (1 week): Confirm credentials, review contracts

- Documentation (Ongoing): Maintain all records

What Financing Options Exist for Hair Implants?

Hair transplant financing in Latin America offers several pathways for patients unable to pay upfront.

Do Clinics Offer Payment Plans?

Clinic Financing Options:

- Brazil: 0% financing through credit partners (6-12 months)

- Deposit plus installments (30% down, remainder in 2-4 payments)

- Split payment (50/50)

- Extended payment with interest (3-8% annually)

International patients face limited access to clinic financing; most programs target domestic patients.

Can International Patients Get Medical Loans?

Loan Options Comparison

| Loan Type | Amount Range | APR Range | Terms | Best For |

| Medical Tourism Loans | $2,000-$25,000 | 9.99%-24.99% | 12-60 months | International procedures |

| Bank Personal Loans | $1,000-$50,000 | 7.99%-22.99% | 12-84 months | Good credit |

| Credit Union Loans | $1,000-$25,000 | 7.50%-18.00% | 12-60 months | Members |

| Online Lenders | $1,000-$40,000 | 11.99%-35.99% | 12-60 months | Fast approval |

| Home Equity | $10,000-$250,000 | 6.00%-12.00% | 5-30 years | Lowest rates |

Specialized Lenders:

- United Medical Credit

- PatientFi

- CareCredit

- Prosper/LendingClub

What Do Package Deals Include?

Standard Package Components

Always Included:

- Hair transplant procedure

- Anesthesia and medications

- Pre/post-operative consultations

- Post-op care kit

- Virtual follow-ups

Usually Included:

- 3-7 nights hotel

- Airport/clinic transfers

- Breakfast

Sometimes Included:

- PRP therapy

- All meals

- Companion accommodation

- Tourist activities

Package Examples:

- Mexico Standard: $4,500 (2,500-3,000 FUE grafts, 5 nights)

- Colombia Premium: $5,800 (3,000-3,500 DHI grafts, 6 nights, PRP)

- Brazil Comprehensive: $7,200 (3,500-4,000 FUE grafts, 7 nights, exosomes)

What Future Trends Will Impact Latin America’s Hair Implant Industry?

The Latin American hair transplant industry faces transformative trends that will reshape competitive dynamics over the next 5-10 years.

Key Trends and Projections

Technology Integration:

- Regenerative medicine becoming standard in premium tier by 2028-2030

- AI-powered planning software for optimal graft placement

- Smaller punch sizes (under 0.8mm) for invisible extraction sites

- Equipment cost reductions democratizing advanced techniques

Market Evolution:

- Consolidation with larger clinic groups acquiring independents

- Mexico maintaining 39.75%+ market share through geographic advantages

- Brazil growing through 215+ million domestic population

- Colombia/Costa Rica as boutique destinations

Regulatory Changes:

- Stronger oversight expected by 2027-2030 in major markets

- Specific hair restoration training requirements

- Stricter advertising controls

- Increased black market enforcement

Demographics Shifts:

- Average patient age decreasing (younger prevention focus)

- Female patients exceeding 40% market share

- Specialization in diverse hair types

- Comprehensive hair health beyond surgery

Economic Factors:

- Continued US healthcare cost escalation driving medical tourism

- Currency fluctuations creating pricing opportunities

- Post-pandemic recovery maintaining momentum

- Technology democratization improving access

The industry will increasingly integrate preventive care, pharmaceutical management, and surgical restoration into comprehensive hair health programs. Patients will benefit from improved technology access, stronger quality standards, and more sophisticated treatment options, though due diligence in clinic selection remains essential as growth attracts both excellent providers and opportunistic operators.

Get started today with Medical Tourism Packages

Choose Medical Tourism Packages’ facilitation services for end to end travel and treatment coordination with vetted clinics, transparent pricing, and 24/7 bilingual support. We arrange consults, flights, transfers, hotels, and aftercare so you can relax and focus on results.

Frequently Asked Questions

Why choose Latin America for a hair transplant?

Latin America offers FDA-approved techniques at prices often 50–80% lower than the US and Europe, with experienced surgeons, modern facilities, bilingual staff, and easy access from North America. Many clinics hold international accreditations (e.g., JCI, ISHRS), making the region a cost-effective and quality-driven choice for medical tourists.

Which Latin American countries are top destinations?

Mexico (≈39.75% market share), Brazil (≈35.71%), and Colombia (≈12–15% est.) lead. Mexico benefits from US proximity and bilingual teams; Brazil has strong ANVISA standards and a large domestic market; Colombia offers comprehensive packages and a well-known cosmetic surgery ecosystem.

How much do hair implants cost in Mexico, Colombia, and Brazil?

Typical ranges: Mexico FUE ~$4,000–$4,500, FUT ~$3,250, DHI ~$2,000, ARTAS ~$5,500. Colombia ~$2,000–$5,000 (often packaged). Brazil FUE ~$3,500–$6,000, FUT ~$3,000–$4,500, DHI ~$4,000–$6,500, ARTAS ~$6,000–$8,000. Per-graft pricing often runs ~$1.00–$3.50 depending on country and clinic.

How are FUE, FUT, DHI, and robotic (ARTAS) different?

FUE (≈66% share): individual follicle extraction with minimal scarring (85–95% graft survival). FUT (≈28%): strip method with a linear scar, efficient/high yield (90–95%). DHI (≈5%): Choi pen implantation for precise angles (≈90%+). ARTAS (≈1%): robot-assisted FUE extraction for consistency (≈85–90%); implantation is still manual. Prices vary by technique and country.

How is pricing calculated—by flat fee or per graft?

Many clinics charge per graft. Example: at $1.00–$2.50 per graft in Mexico, a 2,000-graft FUE costs ~$2,000–$5,000. Some clinics offer flat-rate packages that bundle consultations, medications, PRP, and follow-ups—always verify what’s included and the exact graft count.

How much can I save versus the United States or Canada?

Savings often range 60–83% depending on country and technique. For a 2,500-graft FUE, a US price of ~$15,000 vs. Mexico at ~$5,100 (including travel) delivers about ~$9,900 in savings (~66%).

Who is an ideal candidate for a hair transplant in Latin America?

Candidates need adequate donor density, a stable hair loss pattern, good overall health, and realistic expectations. Age 25+ is preferred for pattern stability. Both men and women seek treatment; women represent about 40% of patients globally.

What does the consultation and surgery day typically include?

Consultations cover photos, medical history, Norwood/Ludwig assessment, donor evaluation, technique selection, and a detailed cost breakdown. Surgery day: prep and anesthesia (~1 hr), extraction (2–3 hrs), graft prep (1–2 hrs), implantation (2–3 hrs), and final instructions (~30 min).

What is recovery like and when will I see results?

Days 1–3: sleep elevated, special shampoo, no exercise. Week 1: gentle washing (day 3–5), avoid sun/strain. Weeks 2–4: scabs shed; temporary shock loss may occur. Growth: shedding at weeks 2–3, new growth by months 3–4, ~50–60% density at months 6–8, ~80–90% by months 9–12, and final maturation at 12–18 months.

How do I verify a clinic’s credentials and avoid the black market?

Verify JCI, ISO, national licenses (COFEPRIS/ANVISA), ABHRS certification, and ISHRS membership/Fellowship (FISHRS). Ask for sterilization and emergency protocols, complication rates, and real patient references. Red flags: unverifiable claims, ultra-low prices (50%+ below market), high-pressure sales, or guarantees of specific outcomes. ISHRS reports black market activity in ~51% of cities—due diligence is essential.

What accreditations and licenses should I look for in Latin America?

Key credentials: JCI (facility accreditation), ISO 9001/13485 (quality systems), ABHRS (physician certification), FISHRS Fellowship (top-tier expertise), and national regulatory approvals like COFEPRIS (Mexico) or ANVISA (Brazil). Always verify on the issuing body’s website or official directories.

Are robotic hair transplants (ARTAS) available in Latin America?

Yes—primarily in Mexico, with limited availability in Brazil (major cities). ARTAS assists with extraction using AI mapping for consistent depth/angle and low transection rates, but implantation is manual. It’s best for straight, darker hair types. Costs in Mexico (~$5,500) are far below typical US pricing ($15,000–$25,000).

Do clinics offer PRP, exosomes, or other regenerative add-ons?

Many clinics provide PRP during or after implantation to support healing and growth; some offer exosomes or stem cell–based protocols as premium add-ons. These can add ~$500–$2,000 to total cost. Evidence is evolving; discuss expected benefits with your surgeon.

What success rates and satisfaction can I expect in Latin America?

Quality clinics report graft survival around 85–95% (technique-dependent) and high satisfaction (often 85%+ in reputable Mexican centers). Brazil’s outcomes are strong under ANVISA oversight (FUE ~88–94%, FUT ~90–95%). Outcomes vary by surgeon expertise, patient factors, and adherence to aftercare.

What risks or complications should I consider when traveling for surgery?

Minor issues (5–15% at quality clinics) include swelling, mild infection, temporary numbness, ingrown hairs, and shock loss. Serious complications are uncommon (<2% at accredited facilities) but can include severe infection, scarring, nerve damage, or overharvesting. Choosing accredited clinics and following aftercare reduces risk.

Do clinics offer packages for international patients, and what’s included?

Yes. Standard packages include the procedure, anesthesia/medications, pre/post-op consults, a post-op kit, and virtual follow-ups. Many add 3–7 nights of hotel and airport/clinic transfers; some include PRP, meals, or activities. Example ranges: Mexico ~$4,500 (2,500–3,000 FUE grafts, 5 nights); Colombia ~$5,800 (3,000–3,500 DHI, 6 nights, PRP); Brazil ~$7,200 (3,500–4,000 FUE, 7 nights, exosomes).

Can I finance a hair transplant if I’m traveling from abroad?

Brazil often offers 0% in-country financing (6–12 months). Many clinics accept deposits plus installments, but most financing targets domestic patients. International options include medical tourism loans, personal bank/credit union loans, online lenders, or home equity—terms vary by credit profile and lender.

When is the best time of year to schedule a hair transplant trip?

Fall/Winter (Oct–Mar) offers cooler temps and lower tourism volumes; Spring (Apr–May) has moderate weather; Summer (Jun–Sep) aligns with work/school breaks but brings heat and sun exposure. Book preferred surgeons 2–3 months in advance and allow 7–10 days off work if possible.

Do I need a visa or speak Spanish/Portuguese to get treated?

Many Latin American countries do not require visas for short stays by US/Canadian citizens, and leading clinics commonly provide bilingual teams and coordinators. Confirm entry requirements and language support with your chosen clinic before booking.

How do currency fluctuations affect the price I pay?

Exchange rates can shift pricing by 5–15% or more. Examples include swings in the Mexican peso (≈17–25 per USD) and Colombian peso (≈3,000–4,800 per USD). Some clinics price in USD to transfer risk; others adjust quarterly. Ask how your quote is pegged and when it’s finalized.

How fast is the market growing and what does that mean for patients?

Latin America’s hair transplant volume is growing at ~15.58% CAGR (2020–2025), outpacing Europe (~8.34%). Annual procedures are projected to rise from ~134,000 to ~179,000. Rapid growth expands options and drives competition on price and quality—making careful clinic vetting even more important.