Book Appointment Now

Medical Tourism Statistics Latin America 2025

500+ Stats on Costs, Procedures & Trends

Discover hundreds of medical tourism statistics and metrics on procedures, costs, patient demographics, market growth, quality indicators, and more across Latin America.

Quick Stats Dashboard

$41.30B

Market Size by 2032

40-70%

Average Cost Savings

1.2M+

Annual Tourists (Mexico)

+400%

Costa Rica Growth

Market Size & Growth Statistics

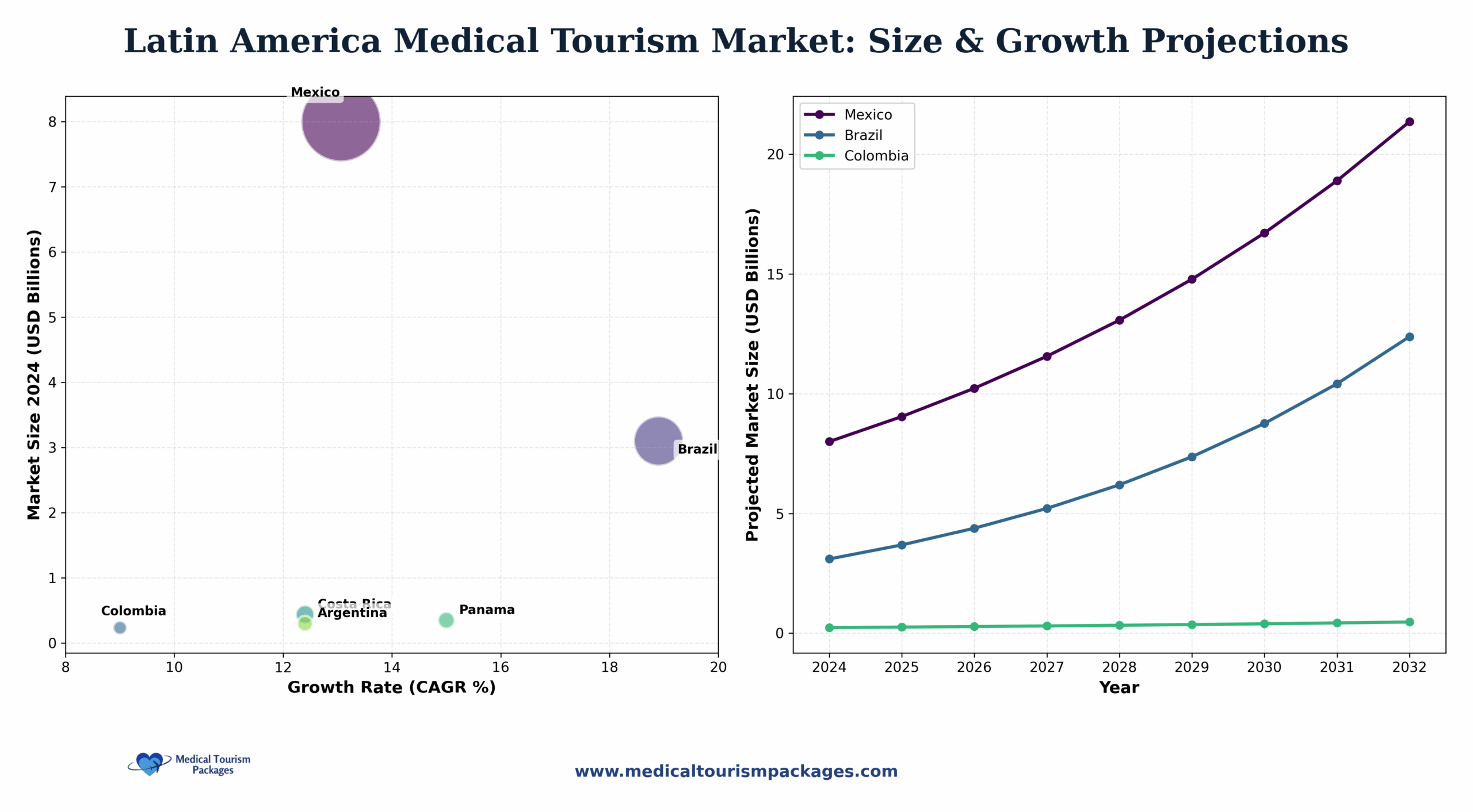

Latin America’s medical tourism market is projected to grow from $10.34 billion in 2024 to $41.30 billion by 2032 at an 18.9% CAGR. This analysis includes data from 50+ research sources including JCI, WHO, ProColombia, and national tourism boards.

Overall Latin America Market:

- 2024 market value: $10.34 billion

- 2032 projected value: $41.30 billion

- 2024–2032 CAGR: 18.9% annually

- Share of global market: ~15% of global medical tourism revenue

By Country (2024 market size):

- Mexico: $8.82 billion (health & wellness ecosystem), $431.74 million (core medical)

- Brazil: $3.10 billion (largest pure medical tourism market)

- Colombia: $235 million (2024), projected $6.3 billion by 2032

- Costa Rica: $437 million (dental & wellness specialization)

- Panama: 50,000 annual medical tourists (dollarized economy advantage)

- Argentina: $300 million revenue target (favorable exchange rates drive 40-80% savings)

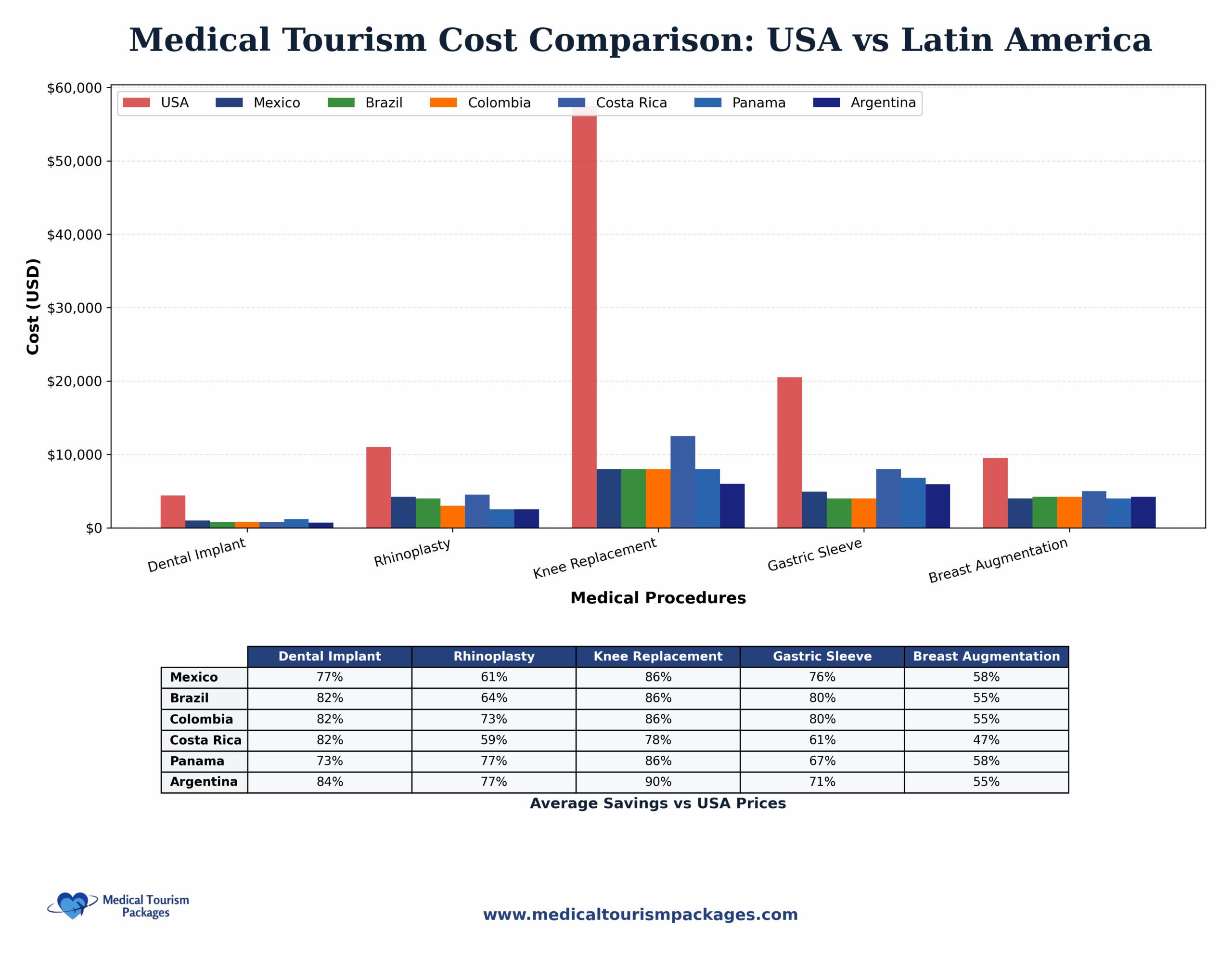

Cost Comparison Statistics (USA vs Latin America)

Dental Procedures: Save ~70%

| Procedure | USA Cost | Mexico | Colombia | Costa Rica | Savings |

|---|---|---|---|---|---|

| Dental Implant | $3,500 | $900 | $850 | $800 | 70-77% |

| Root Canal | $1,200 | $300 | $280 | $250 | 75-79% |

| Full Mouth Restoration | $40,000 | $8,000 | $7,500 | $7,000 | 80-82% |

Cosmetic Surgery: Save 50-70%

| Procedure | USA Cost | Mexico | Colombia | Brazil | Savings |

|---|---|---|---|---|---|

| Breast Augmentation | $8,000 | $3,200 | $2,800 | $3,500 | 56-65% |

| Rhinoplasty | $7,500 | $2,500 | $2,200 | $3,000 | 60-70% |

| Liposuction | $6,000 | $2,500 | $2,000 | $2,800 | 53-67% |

Major Medical/Surgical: Save 60-80%

| Procedure | USA Cost | Mexico | Colombia | Costa Rica | Savings |

|---|---|---|---|---|---|

| Knee Replacement | $30,000 | $12,000 | $10,500 | $11,000 | 60-65% |

| Hip Replacement | $32,000 | $13,000 | $11,000 | $12,500 | 60-66% |

| Gastric Sleeve | $20,000 | $4,500 | $4,000 | $5,500 | 72-80% |

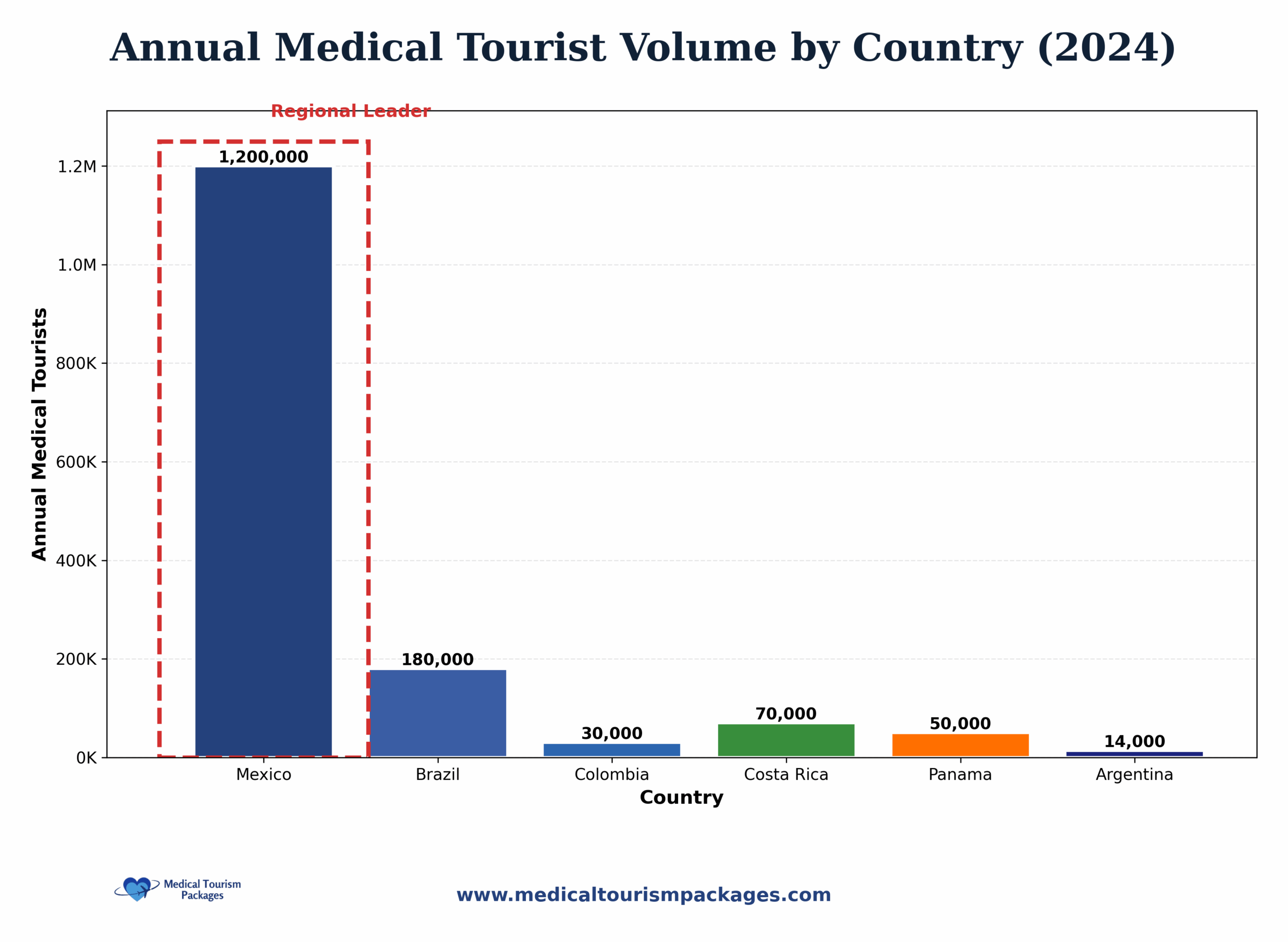

Patient Volume Statistics

Annual Inbound Medical Tourists:

- Mexico: 1.2-3 million medical travelers per year (70% Mexican-American diaspora)

- Brazil: 180,000-250,000 medical tourists annually (14.2% of cosmetic surgeries for foreigners)

- Colombia: 30% of aesthetic procedures for foreign patients (3rd most-used destination globally)

- Costa Rica: 70,000 medical tourists annually ($437 million revenue, ranked #1 globally in 2021)

- Panama: 50,000 medical tourists annually (dollarized economy, Johns Hopkins affiliation)

- Argentina: 14,000 medical tourists (2016), $300 million revenue target

Patient Demographics:

- Age 40–60: Largest patient segment (primary demographic for medical procedures)

- Age 25–39: Primary cosmetic surgery demographic

- Age 55–69: Primary orthopedic and cardiac surgery demographic

- Age 70+: Critical care and complex procedure demographic

Origin Markets:

- North America: 59% of Costa Rica’s medical tourists (USA primary source)

- Europe: Secondary source market (Argentina receives high European volume)

- Intra-regional: Colombia attracts patients from Ecuador, Panama, Caribbean

- Other regions: Limited volume from Asia and other continents

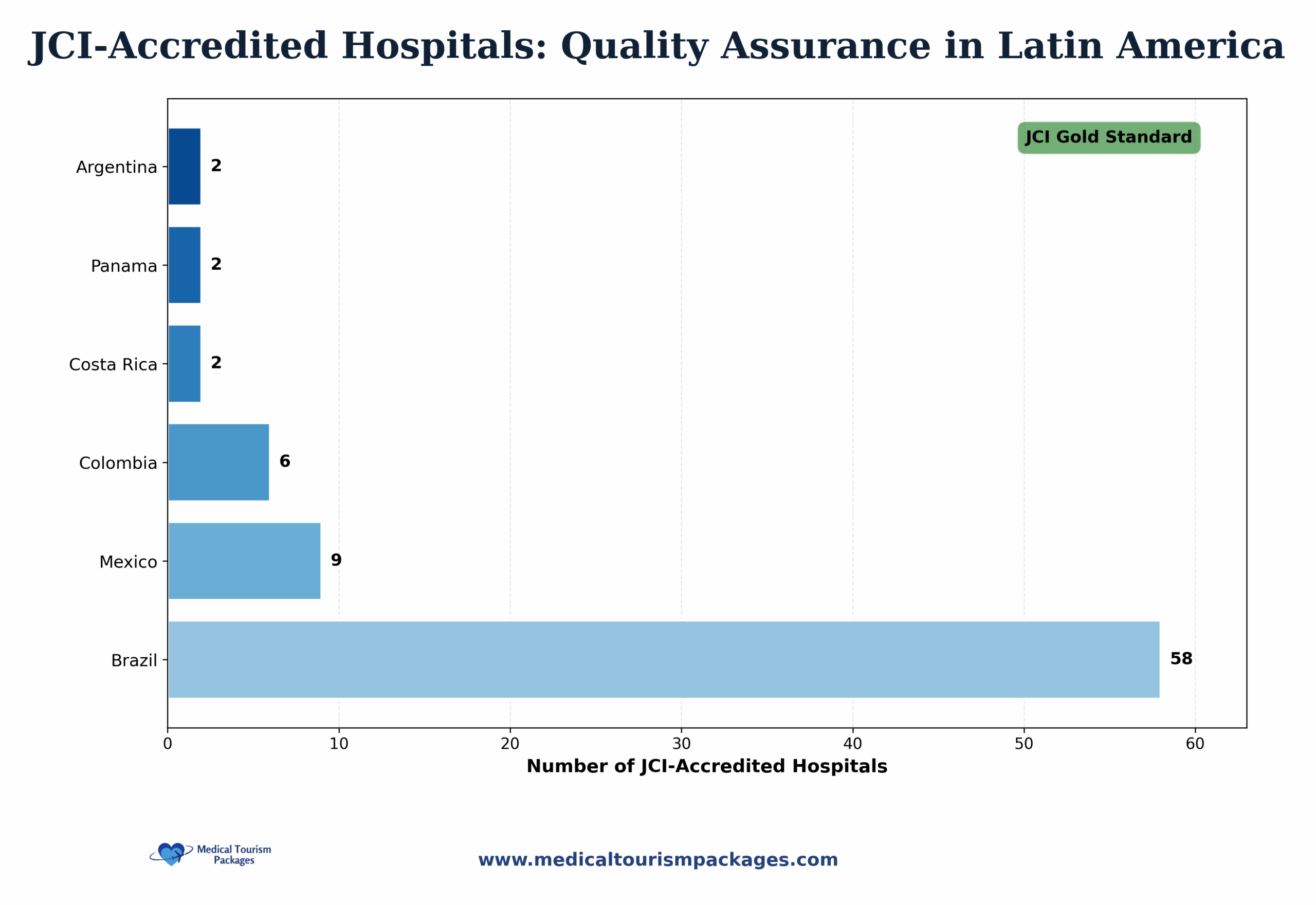

Quality & Accreditation Statistics

JCI (Joint Commission International) accreditation is the gold standard for international healthcare facilities. Here’s how Latin America compares:

JCI-Accredited Facilities by Country:

- Brazil: 58 JCI-accredited facilities (highest in Latin America, 2.1 million surgical procedures in 2023)

- Mexico: 9 facilities (including Médica Sur with Mayo Clinic affiliation)

- Colombia: 6 JCI-accredited facilities (23,323 patients in Medellín 2024, 14% annual growth since 2010)

- Costa Rica: 2 facilities (Hospital CIMA, Clínica Bíblica)

- Panama: 2 facilities (Pacífica Salud with Johns Hopkins affiliation)

- Argentina: 2 facilities (including Hospital Universitario Austral)

Patient Safety & Satisfaction:

- Colombia: 98.2% patient referral rate (460 plastic surgery patients surveyed)

- WHO Healthcare Rankings: Colombia 22nd globally (vs. USA 37th, Canada 30th)

- Costa Rica: 95% dental implant success rate

- Brazil: First non-US JCI accreditation (9.47% of GDP allocated to healthcare)

- Regional Average: 48% positive safety culture score (2022 systematic review)

Recovery Tourism & Innovation Statistics

The future of medical tourism lies in comprehensive care ecosystems and technological innovation:

Telemedicine Growth:

- Latin America telehealth market: $3.48 billion by 2025

- Growth rate: 23% CAGR

- Post-op care solution: Remote monitoring addresses continuity gap

Technology Investment:

- Robotic surgery market: $2.62 billion by 2026

- AI diagnostics: Brazil registered first AI-powered endoscopic device (2024)

- 3D printing: Medical device market projected growth (USD 2.62 billion by 2026)

Recovery Tourism:

- Costa Rica: Pioneer in medical + wellness integration

- Specialized facilities: Post-op retreats with professional nursing

- Market differentiation: Transforms medical necessity into restorative journey

Future Projections & Market Outlook

Strategic forecasts and growth projections for the Latin American medical tourism market through 2035:

Growth Projections by Country:

- Colombia: Target 2.8M health tourists, $6.3B revenue by 2032

- Brazil: $14.84B market by 2033 (18.9% CAGR)

- Mexico: 13.06% CAGR for core medical tourism

- Regional Total: $49.22B by 2032 (41.27% CAGR ecosystem)

Market Risks & Challenges:

- Post-operative care gap: 48% safety culture score indicates system weakness

- Legal recourse: Limited malpractice protection for international patients

- Quality variance: Risk of unregulated “garage clinics” in Mexico

- Currency sensitivity: Market vulnerable to USD strength

Detailed Procedure Statistics & Success Rates

Comprehensive statistics on the most popular medical tourism procedures across Latin America:

Cosmetic Surgery: Brazil’s Global Leadership

- Brazil: 2nd largest cosmetic surgery market globally (2.1 million procedures 2023, over 2.2 million liposuctions)

- Colombia: 3rd most-used destination worldwide (30% of procedures for international patients, ranked 13th for plastic surgeons globally)

- Success Rate: 98.2% patient referral rate (Colombia plastic surgery study)

- Market Value: $1.52 billion South America (2024), 44.37% CAGR to 2032

Bariatric Surgery: Mexico’s Specialization

- Mexico: World leader in affordable bariatric surgery (gastric sleeve $4,000-7,000 vs. $15,000-25,000 USA)

- Cost Savings: Gastric sleeve $4,000-7,000 vs. $15,000-25,000 USA (77% savings)

- Success Rate: 95%+ success rate at JCI-accredited facilities

- Patient Profile: 40-60% USA patients, primarily uninsured/underinsured Americans

Ready to Explore Medical Tourism Options?

Get personalized recommendations and cost estimates for your medical procedure in Latin America.